Why Albania?

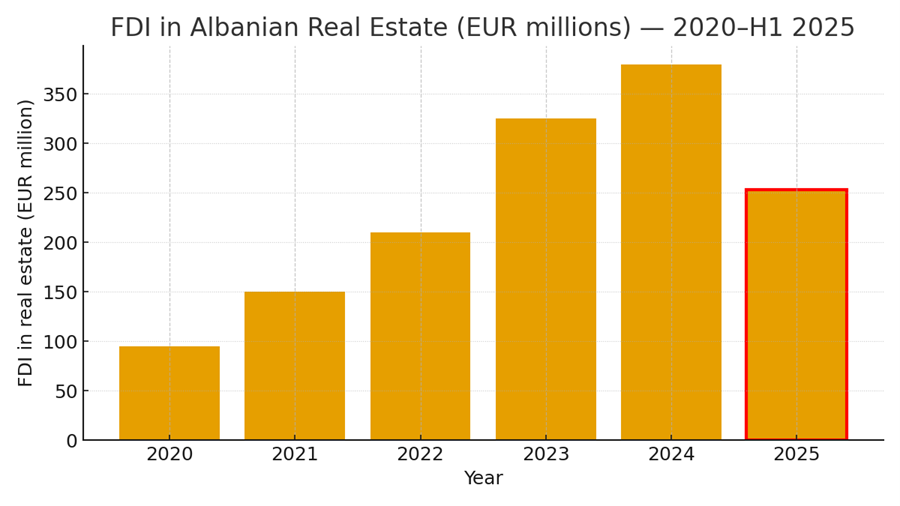

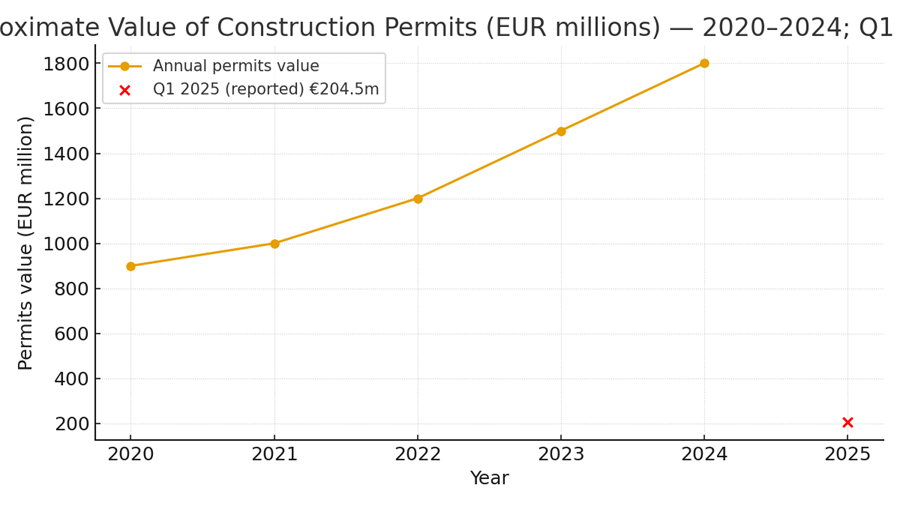

Albania is rapidly emerging as one of Europe’s most attractive real estate markets, giving investors the chance to secure villas and apartments on the Adriatic and Ionian coasts while prices remain low. The country’s economy has grown significantly, with GDP rising from USD 4.35 billion in 2002 to USD 18.92 billion in 2022, and forecasts point to annual growth of 3.5–3.8% until 2029. A booming tourism sector, with 11.7 million visitors in 2024, is fueling strong demand for properties and driving long-term value growth. At the same time, NATO membership since 2009, anti-corruption reforms through SPAK, and security collaborations with EU partners have made Albania a safer and more reliable investment environment.

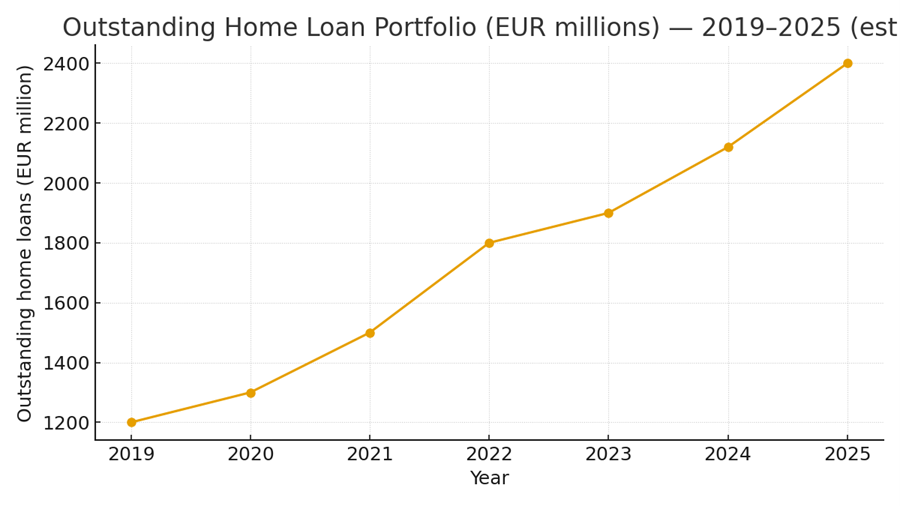

Another key driver is Albania’s path toward EU integration. Accession negotiations began in 2024, with potential membership expected by 2030, supported by the EU’s €6 billion Reform and Growth Facility, of which €922 million is allocated to Albania. This process is bringing legal security, investment protection, and market transparency, all of which enhance investor confidence. Buying in Albania today means early access to prime coastal properties at attractive prices, the potential for high rental yields through tourism, a wave of new infrastructure, modern airports, marinas, highways, railways and long-term capital appreciation as the country advances toward EU membership and continued economic expansion.

Property Law for Foreigners

Foreign buyers can legally purchase and fully own apartments, villas, and commercial properties in Albania with the same rights as local citizens—no residency required. Titles are protected under the Albanian Constitution and Law No. 79/2021, which also allows property owners to apply for a temporary residence permit.

All purchases must be registered with the State Cadastre Agency (ASHK) to ensure legal ownership. Agricultural or undeveloped land has restrictions and may require forming an Albanian company or meeting residency criteria.

Highlights:

- 100% ownership for all nationalities

- No residency requirement for residential or commercial property

- Property purchase can support residency applications

- ASHK registration guarantees title protection

Taxation & legal guidance

Owning property in Albania combines the appeal of a Mediterranean lifestyle with a straightforward, investor-friendly legal framework.

- Low Purchase Costs: A property transfer tax of around 2-3% keeps acquisition expenses competitive.

- Favorable Annual Taxes: Residential properties taxed at only 0.05%, commercial at 0.2%.

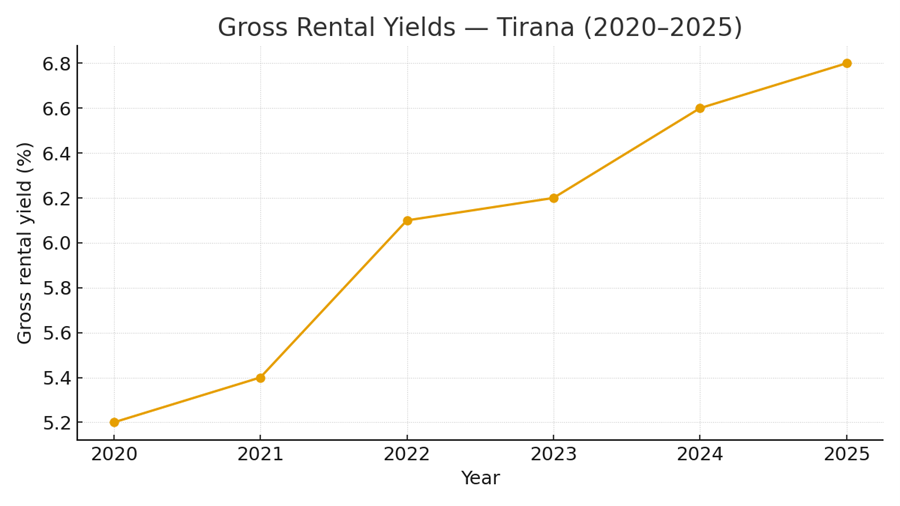

- Attractive Rental Yields: Flat 15% rental income tax with allowances for deductible expenses.

- Capital Growth Advantage: 15% capital gains tax on sale, with exemptions often applying after two years of ownership.

- Smart on VAT: Only new builds from developers carry 20% VAT; resales are VAT-free.

With expert legal partners and tax specialists by your side, we ensure your purchase is fully compliant, your ownership is protected, and your investment potential is maximized—so you can focus on enjoying your new home by the sea.

faq

Frequently Asked Questions

Foreign nationals—regardless of country of origin—may purchase and fully own apartments, houses, villas, and under the same legal conditions as Albanian citizens. There are no nationality-based restrictions on commercial real estate on ownership percentage.

Foreigners do not need to be residents or citizens to proceed. Only agricultural land, forested, or protected areas require a local company or special arrangements. It’s highly recommended to work with a notary and a lawyer to ensure the title is clean and the transaction is legally sound.

No. You do not need residency to invest in real estate. However, property ownership can support your application for a temporary residence permit. A local Tax Identification Number (NIPT) is required for the transaction.

The process generally follows:

- Find the property via trusted agents.

- Sign a preliminary agreement and pay a deposit (appx 10%a).

- Conduct title and legal checks via a lawyer and notary.

- Sign the final deed with a notary.

Register the property with the Cadastre ( immovable Property Registration Office) to secure your ownership. According to the legal process this will be covered by notary, on behalf of yours.

- Transfer Tax: Around 2–3% of the property value.

- Notary & Legal Fees: Typically, 1–2% combined.

- Registration Fees: Usually €50–€.100

- Annual Property tax: Typically under € 100

- Cash vs Bank Transfer: Bank transfers are highly recommended for amounts exceeding €700 due to legal transparency and fraud protection.

VAT: 20% only on new builds sold by developers; resale properties are VAT-exempt.

Yes, but with conditions. Many foreign buyers opt for cash purchases. If considering financing, some banks—like Raiffeisen and OTP—offer loans up to 70–80% of the property value, with interest rates ranging from 4.5% to 7.5%. You’ll need a solid income history, extensive documentation, and potentially a local guarantor.

Each property sale must be completed before a licensed notary, who is legally required to verify the property’s cadastral registration, ownership legitimacy, and absence of disputes. If any issues are found, the notary must halt the transaction.

Yes, vigilance is key. Some common concerns include:

- Legal/Title Issues, such as “double selling” or flawed ownership documentation—avoided through due diligence.

- Zoning or Heritage Restrictions, particularly near protected or UNESCO areas.

- Construction Risks, including non-compliance with seismic standards.

- Currency and Corruption Risks, such as unofficial payments.

A trusted lawyer can help manage these.

- Properties lacking building approval or zoning compliance.

- Remote listings without proper documentation or agent credibility.

Always hire a local lawyer, inspect the property, review the cadastral records, and avoid making payments before due diligence is complete.